Secure

Your Future

Protecting Your Loved Ones with Reliable

Life Insurance Solutions

What is universal life insurance?

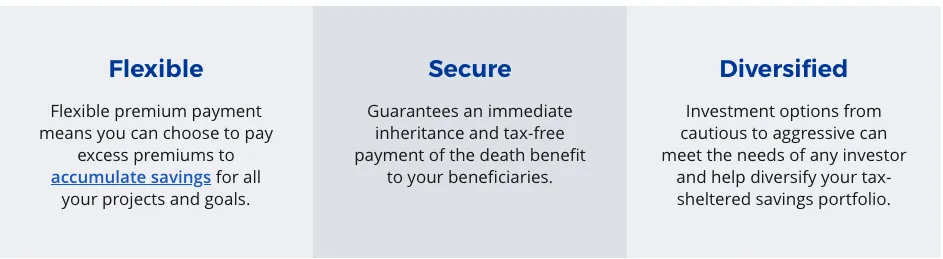

Universal life insurance is a very flexible financial tool that provides your loved ones with financial security adapted to your personal, family and work situation. This type of insurance combines under one contract two essential elements of sound financial planning: life insurance and tax-preferred savings.

Coverage adapted to your needs

How does it work?

A portion of the premiums you pay is used to cover the cost of insurance and taxes. The excess is invested in options that match your investor profile.

Insurance coverage

Permanent life insurance provides protection for your entire life and allows you to customize your coverage with the cost of insurance, the death benefit, the face amount, and the premium paid. With insurance adapted to your needs, you can protect your family or your business against the financial burden that results from death.

Savings

The savings portion is invested and generates income that accumulates tax-free. A wide range of investment accounts can be tailored to your needs. Additionally, there may be investment bonuses available (for example, starting in the first year for certain index accounts).

A product that adapts to your needs

Level cost options

The level-cost option gives you fixed insurance costs for the life of your policy. Your premiums stay the same year after year, making it easy to budget and plan long term.

Premiums are guaranteed and never increase.

You can choose to pay for 10, 15, or 20 years, or continue paying until age 100.

Once paid up, your coverage remains in force for life.

No surrender charges apply under this cost structure.

This option is ideal if you want stability, predictable costs, and the flexibility of shorter payment periods.

Yearly renewable term (YRT) costs of insurance

With the YRT option, the cost of insurance starts lower but increases each year as you get older. This makes it attractive if you want affordable coverage in the short term or if you don’t plan to keep the policy for your entire lifetime.

Premiums increase annually based on your age.

Good for clients who need insurance temporarily, such as for business coverage or during high-debt years.

If kept long-term, it often becomes more expensive than the level-cost option.

Some policies allow you to switch from YRT to a level-cost structure later on.

Surrender value

The surrender value is the amount of money you receive if you cancel (or “surrender”) a permanent life insurance policy before death. It reflects the policy’s accumulated cash value minus any applicable fees or outstanding loans. The longer you keep the policy, the higher the surrender value usually grows.

Disability benefits

Disability benefits are optional riders you can add to a Universal Life policy to provide extra protection if you become disabled and can’t work. Depending on the rider, they can:

Waive your insurance premiums so your coverage and savings continue even while you’re not earning an income.

Provide a monthly income benefit to help replace lost income.

Offer lump-sum coverage in case of a permanent disability.

These benefits ensure that your insurance and savings goals stay on track, even if a disability prevents you from working.

Additional information

Eligibility

Most adults can apply for Universal Life insurance, and eligibility is based on age, health, and lifestyle. Applicants usually complete a health questionnaire and may undergo medical underwriting, depending on the amount of coverage and insurer. Non-smokers and healthy individuals generally qualify for lower premiums, but there are also simplified issue options available that don’t require a medical exam.

Universal Life is best suited for people who:

Want lifelong coverage (not just temporary protection).

Have already maximized RRSP and TFSA contributions and want additional tax-advantaged savings.

Are looking for flexibility in premiums, coverage, and investment choices.

Death benefit

The death benefit is the amount paid to your beneficiaries when you pass away. With Universal Life, you can often choose between:

Level death benefit – a fixed amount of coverage.

Increasing death benefit – the coverage plus the accumulated cash value.

The death benefit is paid tax-free to your beneficiaries and can be used to replace income, cover debts, pay final expenses, or support estate planning.

Investment options

Universal Life policies include a built-in savings component where you can invest contributions above the cost of insurance. Depending on the insurer, options often include:

Guaranteed interest accounts (safe, steady growth).

Index-linked accounts (returns tied to stock market indexes).

Segregated fund options (similar to mutual funds, with insurance guarantees).

Any growth inside the policy is tax-deferred, and you can usually adjust your investment choices as your goals or risk tolerance change.

Other features

Universal Life (UL) policies offer a mix of lifelong insurance coverage and flexible savings options. Some common features include:

Flexible premiums – you can pay just the minimum required or add extra contributions to grow savings.

Customizable death benefit – choose between a fixed amount or one that grows with your cash value.

Investment choices – allocate extra contributions to guaranteed accounts, index-linked options, or segregated funds.

Cash value access – borrow or withdraw from your policy’s savings portion if you need liquidity.

Tax advantages – growth inside the policy is tax-deferred, and the death benefit is usually tax-free to your beneficiaries.

Optional riders – add extra coverage like disability benefits, critical illness, or child protection.