Secure

Your Future

Protecting Your Loved Ones with Reliable

Life Insurance Solutions

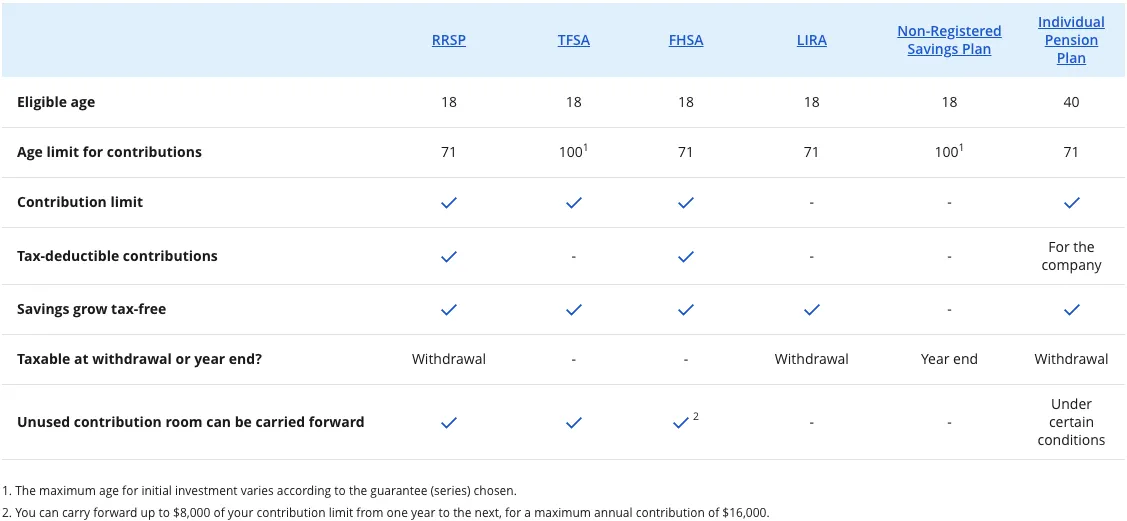

RRSP, TFSA, FHSA AND OTHER SAVINGS PLANS

Whether you’re looking to buy a home, plan for a trip or build your retirement income, you’ll find a range of products to help you reach your goals.

Discover the advantages of our various savings plans such as RRSPs, TFSAs, FHSAs, IPPs, LIRAs and non-registered plans.

Got questions? A financial security advisor can help you select the product or products that will allow you to reach your goals.

What are segregated funds?

Segregated funds are investment products offered by insurance companies. They work like mutual funds but include insurance guarantees that can help protect your principal at maturity or death.

How are segregated funds different from mutual funds?

Like mutual funds, segregated funds pool money from many investors into professionally managed portfolios. The difference is that segregated funds come with unique benefits such as maturity and death benefit guarantees, potential creditor protection, and the ability to bypass probate.

Who are segregated funds best suited for?

They’re ideal for investors who want market growth potential combined with insurance protection. Segregated funds may appeal to business owners, professionals seeking creditor protection, or families looking for estate planning advantages.

What guarantees come with segregated funds?

Most contracts guarantee 75% to 100% of your original investment at maturity (after 10 years) or upon death, regardless of market performance.

Can I access my money if I need it?

Yes, you can redeem units of your segregated fund at any time, but withdrawals may be subject to fees or market value fluctuations.

What are the main advantages of segregated funds?

Professional investment management.

Maturity and death benefit guarantees.

Potential creditor protection.

Ability to bypass probate and pass money directly to beneficiaries.

Are there any disadvantages?

Segregated funds often come with higher fees (called MERs) than mutual funds, and guarantees may limit growth potential. They’re best suited for those who value protection and estate planning benefits.